Forgotten Components of Interest Rate Risk at Community Banks

Social media best practices in the financial industry are tough because regulation becomes a real issue. Fortunately, there are some helpful platforms, such as Social Assurance, that assist in marketing automation (which is essential in 2017!) and ensure your social posts are compliant. Once you’re confident with the regulatory side, it’s all about value.

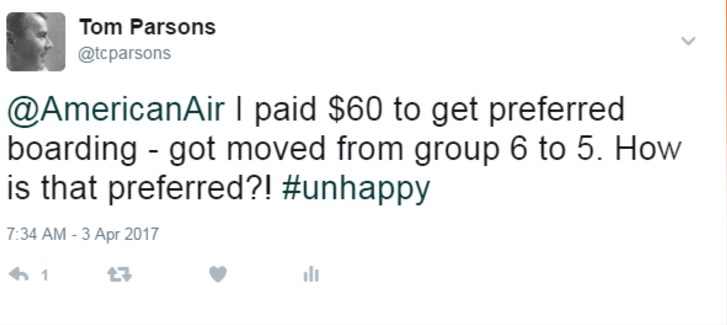

Last month I experienced the best service possible. It was from American Airlines (no, really) – and it was through social media of all things.

The Community Bank Strategic Planning Experiment: Using Your Model To Prepare for Rising Interest Rates

By 2020, millennials will account for 50% of the global workforce (PWC). And according to Gallup, only 29% of millennials are currently engaged at work.

That puts employers in a tough spot, considering this generation will eventually be charged with leading these organizations. And banks are not immune!

What is your bank doing now to prepare for the inevitable millennial takeover?

The FMS Forum: A Sneak Peek of My Talk on Millennial Employees

Plansmith will be at The FMS Forum in June. We'll be in the marketplace, and I'll be presenting a breakout session!

Social video is hot right now. So hot in fact that 90% of users say that product videos are helpful in the decision process (Hyperfine Media).