We have some exciting news! Our first installment of Plansmith’s Client Spotlight Series is here. Our intimate spotlights are designed with you in mind. You’ll hear firsthand from our guests as they share their real-life experiences with planning, budgeting, managing risk, and making strategic business decisions.

Oh, Autumn. The changing of the leaves, the crispness of the morning air... and the crunching of numbers?

Yep. We're bankers. It's what we do. And fall, it's the perfect time for some of our favorite - and most crucial - banking activities.

Here are the 3 game-changing activities Plansmith recommends starting as early as possible in the fall:

There’s something about summer that always represents freedom to me. It could be the Fourth of July resonating past the day of, or it could be the warm weather and carefree attitude that comes with it. Maybe it’s the road trips we take and barbecues we host with friends and family. Maybe it’s the trips to the pool or the beach. Maybe it’s the general sense of enjoyment that we try to soak up before the weather gets crisp again.

Most of us hate planning. So why would I want to start now, when I could wait until the usual time next year?

Actually, there are two great reasons to plan early and often:

One of the most common calls we take at Plansmith is from a bank or credit union looking to improve their entire budgeting, forecasting, and board reporting process. While the organizations vary greatly in size, and the person calling is sometimes the president and other times a financial analyst – most often they all have one thing in common: “I’m currently using Excel.”

If COVID-19 has taught us anything, it’s that plans change.

For example, I had a cruise booked and paid for, including excursions to play with sea turtles and visit Mayan ruins this spring. Two of my close friends and I were set to venture from Tampa to Cozumel, Belize, and Honduras – live our best tropical lives, if you will. We were supposed to set sail April 19th and return April 26th.

Managing Consolidated Performance Objectives: Why A Unified Software Platform Is So Important

As Plansmith’s ‘budgeting software’ evolved from its onset in the early 1970s, it became referred to as a ‘profit planning model.’ This distinction was made because it was much more than just balances on a spreadsheet or basic historical trends cast forward for the next year.

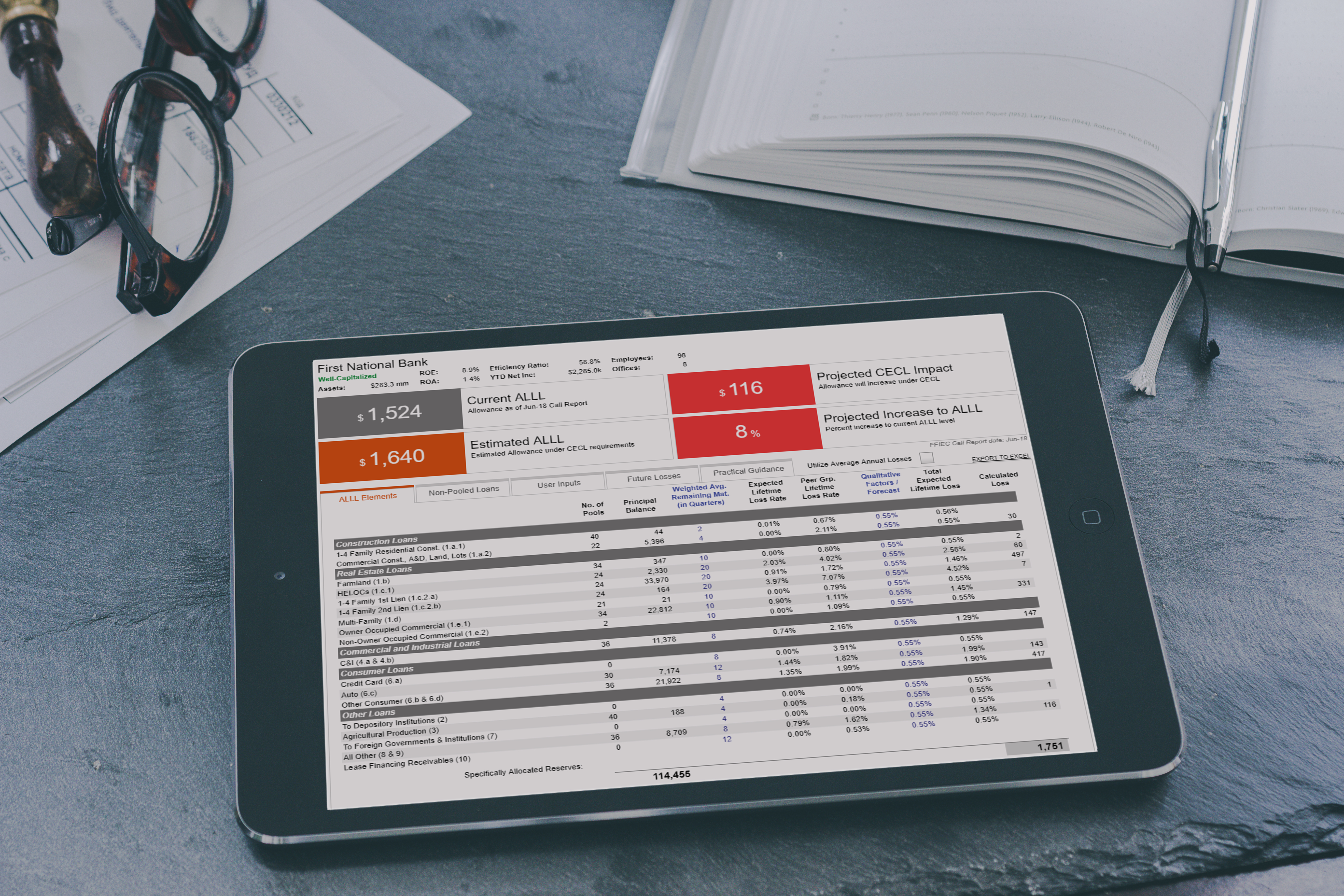

By now, you’re probably wondering what to do about CECL. Although it’s been delayed, the fact is that CECL is still happening. In our educated opinion, now is the time to start finalizing CECL plans.

Here are four reasons why we believe financial institutions shouldn’t wait to implement CECL.

Do you have appropriate policy limits for all key interest rate risk measurements? How did you set your set them, and do they really still make sense for your institution?

When market rates weren’t changing, most institutions were in general compliance with policy limits. However, with the steady ramp up of rates through mid-2019, and then the massive drop in March of 2020, we’ve seen numerous financial institutions fall out of policy compliance. We’ve also heard from many of our clients that just aren’t sure what they should use for limits for the various non-parallel rate shock scenarios and now emphasized net income shock measurements. The old industry standard limits that so many institutions are still using just don’t seem to be working anymore.

Plansmith believes in the power of planning to help manage the future.

Our mission has been to provide the best tools and services to strengthen execution for sustained growth and quality earnings. Over the past 50 years thousands of financial institutions have benefited from the tools we build and the services we offer.

In the current crisis there is no better time to rethink the use of complicated and confusing systems in favor of an easier, more flexible and a more understandable way to avoid the risk of bad decisions. Plansmith provides resources including dedicated people, expert advisors, educational offerings and great decision technology components for managing your future.