As you grow, your organization has more and more things to manage.

- Strategically, you’re working to find the right markets to penetrate with the ideal products and services.

- Financially, you’re making sure your earnings are meeting or exceeding targets.

- And organizationally, you’re looking for the right talent to expand and grow.

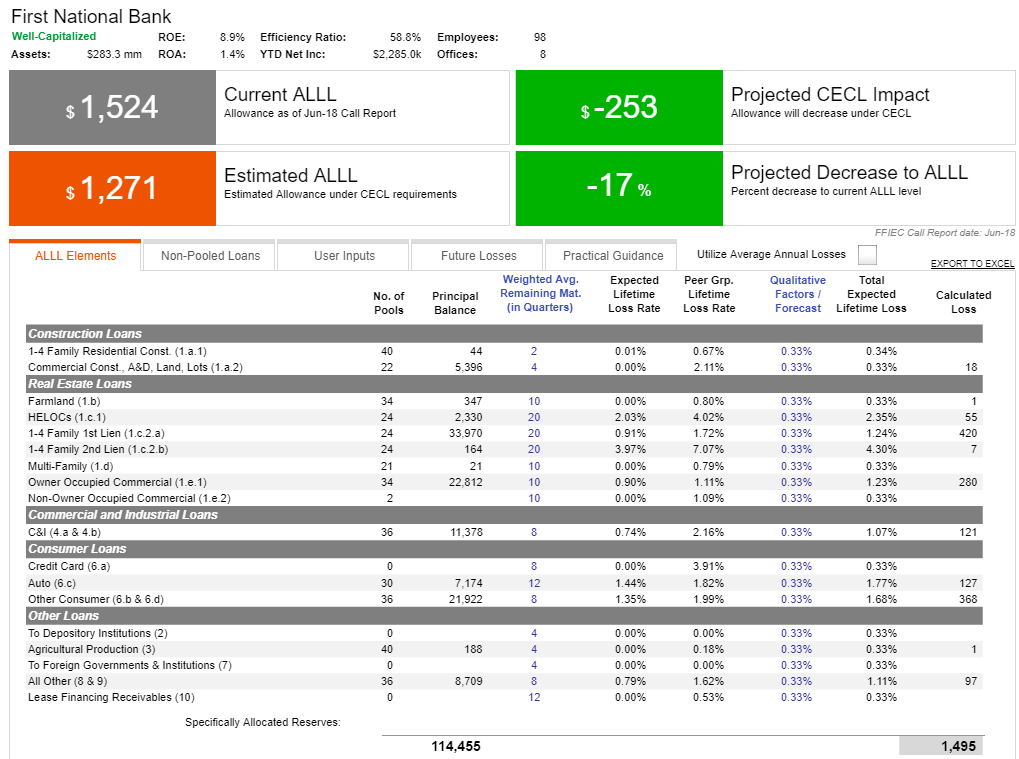

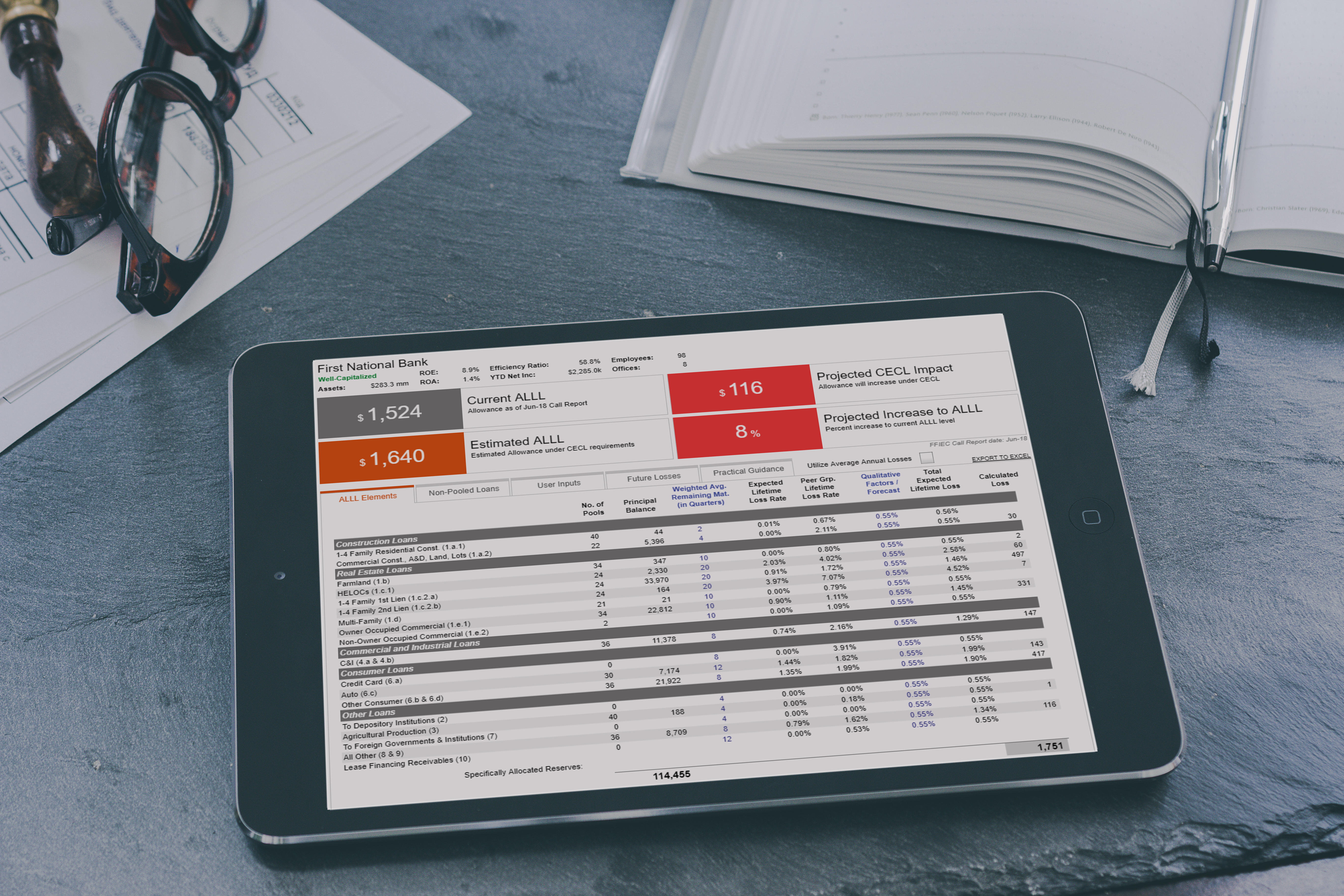

One thing you can’t ignore is the role Interest Rate Risk plays in the banking industry today.