Our recent blog discussed Product Profitability, or the process of analyzing your product line by looking at each asset category and adjusting its yield by adding non-interest income, and subtracting applicable loan losses and overhead. The overhead we associated with the asset was its funding liability cost less applicable service charges. This gave us a more heightened awareness of the true earning potential of each earning asset.

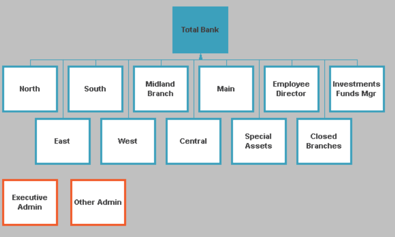

Let’s examine a different type of profitability, known as branch or cost center profitability. Although this method is on a much larger scale, its purpose is similar. Physically, it’s a whole new level of plan development and tracking. With that, it includes a variety of contributors from deposit gathering branches, to lending offices, as well departments, such as investments and operations.To begin, you’ll need a process or model for developing a business unit/branch budget. This scale of plan development may look something like this:

To realize the profitability of any given branch or department (aka units), we must budget at the unit level. Some units will be deposit gatherers or funding units, and others will be funds users, making loans and investments with those funds.

A business unit budget allows the institution to assign accountability, and measure each unit’s current profitability and plan for its future. Profitability by unit can be measured and monitored giving management greater control and the ability to make better-informed decisions.

As some units are funds gatherers and others funds users, at Plansmith, we automatically balance the sheet using either a Funds Pool In or Funds Pool Out approach. The use of the Funds Pool accounts allows the User to designate a Cost of Funds usage (Funds Pool In) or Credit for providing funds (Funds Pool Out). The rate of exchange is determined by the institution based on other rate models within its balance sheet. Typically, this Cost of Funds or the Funds Transfer rate is ascertained and assigned across all business units.

One of the benefits of a business unit application is that the unit manager receives a departmental income statement of a fully-absorbed cost basis. This means that unit’s financial statements are managed as if it were a stand-alone bank. The statements are virtually identical!

Through the use of a business unit model, the user can assign an allocation of costs from cost centers to profit centers on a percentage basis. Each profit or cost center will be able to see the direct costs attributable to its department.

Additionally, there would be other factors within a branch/departmental unit budget plan including allocation of overhead and capital to each unit. These are strictly for the unit itself and would be eliminated at the consolidated Total Bank summary.

These allocated accounts are used for balancing each branch or department and forecasting its profitability. When consolidated into the Total Plan level, these allocations are ignored and balances are removed so that only the true Fed Funds position is reflected.

Here are some of the benefits of a business unit system:

- Control to budget top-down or bottom-up

- Automated allocations to business units

- Funds transfer pricing

- Cost allocation

- Capital allocations

- Branch and Department participation, feedback and tracking

- Unit Profitability Performance Reporting

- Holding Company consolidation and reporting with automated eliminations

- Full Reporting and variance capabilities at any department, region, or total bank level

Deciding to expand your corporate budget into a business unit system should not be taken lightly. There are many factors to consider, such as your core processor’s ability to provide all necessary business unit identifications within your general ledger, loan, and deposit applications. However, moving into a business unit system greatly encourages participation from your management team. It provides each with responsibility and accountability, while also providing them a way to be more involved in the success of the organization. Each unit manager can plan their budget, test alternatives, receive financial feedback, and collaborate in a whole new way with senior management.

Sue West

Sue West

President