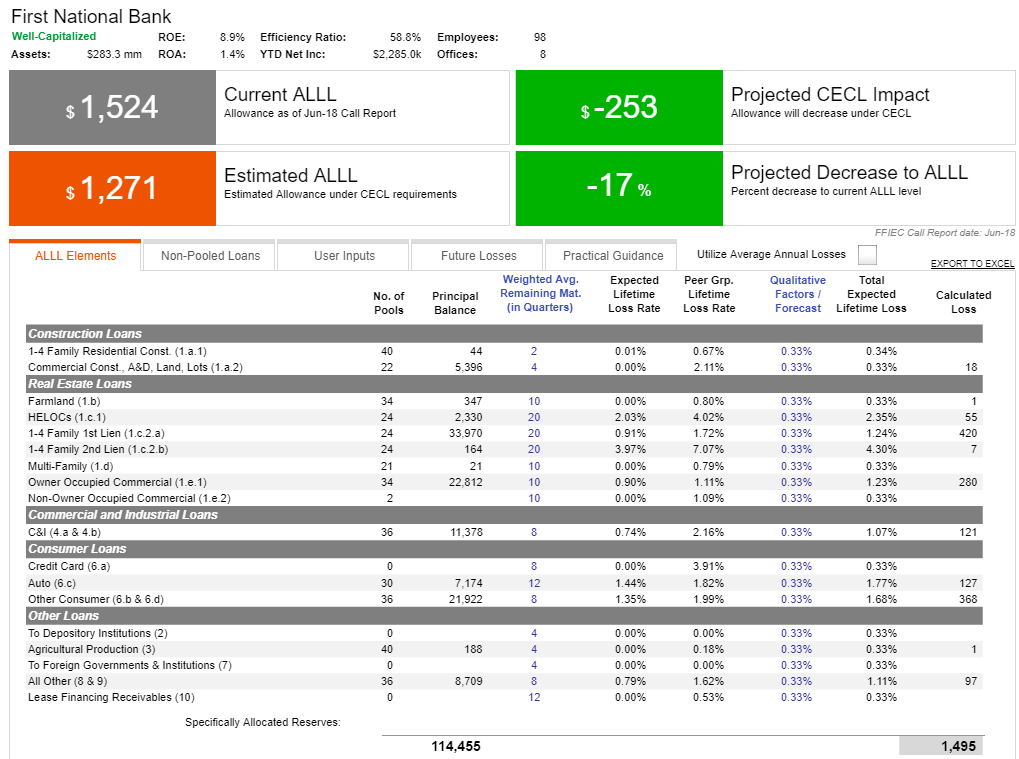

As a financial leader, you’re no stranger to balancing strategy, compliance, and performance. But if there’s one task that continues to demand more of your time than it should, it’s likely CECL reporting.

You’re not alone. Across the country, CFOs, controllers, and entire CECL committees are hitting a breaking point with their current CECL solutions, especially as the original wave of contract renewals comes due. If you’re stuck wrestling with expensive, clunky platforms, endless spreadsheets, and reporting tools that seem more confusing than helpful, this might be the best opportunity you’ll get to reassess.

Here’s why now is the right time to take a closer look, and why so many financial institutions are making the switch to Plansmith’s all-in-one CECL solution.

.jpg)