A common misconception is that planning is an annual event. Budgeting: setting targets and allocating expenses; true, but what happens next? As life goes on, rates fluctuate, new opportunities for growth appear, and your ever-changing customer expectations must be managed. Your budget, as it was initially locked in, must die and be reborn accordingly.

There are several ways to get a better handle on your financial future and get your plan back on track to meet your goals.

Three courses of action to regain control and hit your targets:

Frequently reforecast: Considering the turbulent rate environment and shifting customer deposits, liquidity and cash flows must be monitored closely. Additionally, refreshing your forecasts needs to be an ongoing priority.

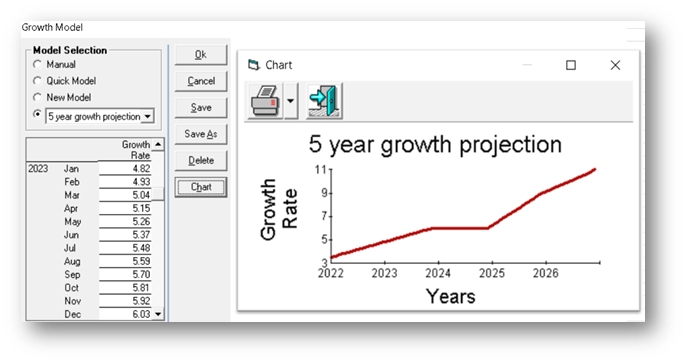

With your budget stored safely away, opportunity lies in the ability to manage, or reforecast, your plan based on your current position. Reforecasting even small changes in rates or balance sheet mix will provide a more accurate expected outcome. A planning model, in place of manual entries, will make plan adjustments a fluid exercise as your data will auto-adjust based on current activity. Models allow you to look ahead and anticipate change, thus helping you prepare for adjustments that will keep you on track to reaching your performance goals.

Break your budget into units: As your organization grows, especially through acquisition and branching, it may help for your budget to reflect those unique units. For example, if branches serve differing markets, it will be more manageable to accurately account for those targets with a branch budget model. For example, our branch model provides branch managers the convenience to contribute via cloud-based input, with accessibility to review their branch performance on a monthly basis.

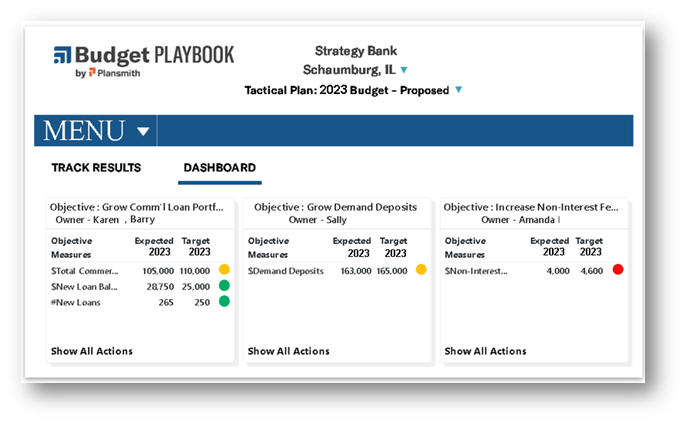

Document a plan of execution: Regardless of how well you are able to model your financials, they can be a shot in the dark without a qualitative plan to reach your targets. While strategic planning is often looked at as a daunting task, tools like Plansmith's Budget Playbook help you bring your budget to life in a visual and collective way. Add clarity to your planning process by assigning ownership, targets, and resources with a cloud-based playbook.

Professional planning tools from Plansmith make it easy to take control of your financial goals in any economic environment. One system brings together the power of budgeting, forecasting, liquidity and cash flow modeling, ALM/IRR, and strategic planning for any organization.

Our software helps you project your bottom-line, anticipate setbacks, communicate with your Board, and satisfy Regulators.

Click here to discuss your current situation, review our solutions, or discuss if outsourcing to our team of former examiners is right for you.

Sue West

Sue West

President