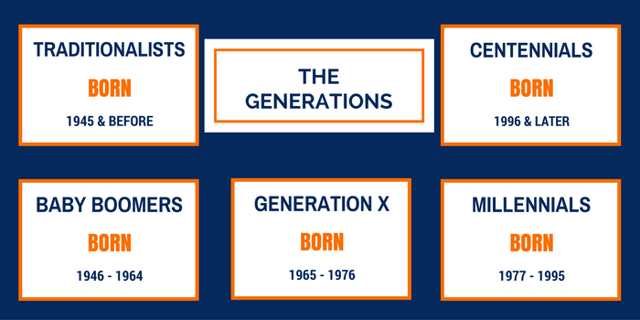

There is a lot of buzz surrounding millennials and their unique psychographics and behaviors, especially with regard to buying habits. But it's not just millennials that are exhibiting fascinating (and at times, frustrating) preferences. As Jim Perry of Market Insights and #BANKSOCIAL discusses in his article, Modern Demographic Cohorts, Defined By Expectations, Want The Same Things From FIs, other generations, including baby boomers, are stepping outside of their perceived demographic[s] and assimilating with attitudes, beliefs and even behaviors of diverse age groups.

The Generational Melting Pot Effect

Although this generational melting pot effect may be exhausting for retailers, marketers, and yes, banks, it presents an opportunity for businesses that can best interpret and execute on these consumer behaviors. Similar to and perhaps in conjunction with the progression of FinTech, the act of disrupting outdated incumbent banking industry norms will result in winning companies chosen by the happiest, most satisfied customers. The question all of this presents is: What is the common ground upon which these generations are agreeing?

A few years back there was a song by Toby Keith that took country radio by storm. You could hear it everywhere--malls, bars, restaurants, coffee shops, you name it. It's called, "I Wanna Talk About Me," and with a tongue-in-cheek title like that, it's no wonder it went viral; but it's also quite relevant to this article. Perhaps the most generalized stereotype derived around millennials is their love for themselves--their focus on me and how I can get the most out of this experience. Although this may sound harsh, it's fairly accurate; however, does it only apply to millennials?

Even Time Magazine featured an article by Joel Stein with a seemingly severe perspective on the millennial generation, or as they put it, "Millennials: The Me Me Me Generation." However, the same article grows to expose millennials as "the greatest generation of optimistic entrepreneurs..." Though littered with a mix of highs and lows of the millennial generation, there are interesting thoughts to be gained from the article. It may be true that millennials exhibit higher narcissistic tendencies (3-times higher than those ages 65+, according to Time), but is it possible that the same self-centered behaviors apply to other generations, especially in buying situations?

Trending Towards Tech & The Return To Local

As a society, we have become accustomed to technology and the convenience it provides. Whether we choose to use it ourselves or not, it's all around us: in advertisements, at stores, at banks. Even if my grandmother chooses to stand in line for 10 minutes longer at the grocery store instead of using the self-checkout lane, her brain is still absorbing the effects of the technology. The fact is, age is becoming less of a factor in the expectation of fast service, and the tendency for the public as a whole is geared toward quick satisfaction. Patience is no longer a virtue exercised by most Americans when it comes to spending their hard-earned money. The winner of their business will be the brand that can execute on their high expectations for both quality and service, and do so yesterday.

Where do community banks fit into this discussion? With megabrands like JPMorgan Chase, Amazon, Starbucks and Nike rising to meet customer expectations with the velocity of the multibillion-dollar companies they are, it might sound like there is no chance to compete. The bright side to the equation is a value that millennials as a whole tend to hold very dear: local markets. And with the generational melting pot effect in play, this value is leaching into other generations at a high rate of speed. Companies like Whole Foods have been able to analyze this movement and capitalize on it with extreme success at a national (now global) level. However, it doesn't take a national company to utilize the return-to-local fervor; in fact, community brands, including banks, have a huge advantage: they understand the market because they are, in effect, the market. It's community banks that are sponsoring middle school sports teams. It's community banks that are volunteering at the hometown food bank. And, you guessed it, it's community banks that are granting loans to bolster small business in their communities. Community banks know their market because they live in that market--who better to provide both the quality and service the evolving local market wants and deserves?

The answer, in effect, is nobody. However, there remains a challenge.

The FinTech Challenge

In conjunction with the speedy delivery and overall quality of service expected, a high degree of intelligent, easy-to-use technology is presumed. What does this mean for community banks? It means that FinTech, a scary term for most community bankers, comes into play, and in a big way. In some ways, this should be a scary term because it is easily the most difficult hurdle community bankers must overcome in competing with the Bank of Americas and Wells Fargos of the world. When FinTech first stormed the banking world, simply offering online banking was an acceptable ode to the movement. Now, as consumers are savvier than ever, online banking alone is not even close to acceptable.

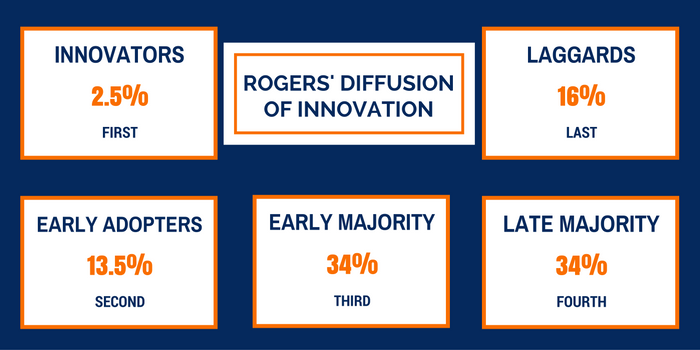

How can a small bank compete, then? The Financial Brand discusses this issue at length in their article, How Small Banks Can Partner with Fintech Firms. Reflective of the point I'm trying to get to, the article uncovers a heavy-hitting bone of contention: large banks are beginning to partner with FinTech firms, whereas only 55% of small banks and credit unions have even begun to meet with potential partners. Why is this an issue? Because the biggest barrier to entry in the FinTech sphere is capital, and capital is what most small banks are lacking relative to large banks. As obvious as this may sound, one would assume said banks would understand the urgency in finding a support system--a guiding light, if you will--through the tumultuous world that is FinTech. Unfortunately, as is incumbent of the banking industry, they are predominantly laggards in the phenomenon. The truth is, economies of scale are at play here. Large banks have the capital to throw at direct FinTech partnerships, or to invest in their own technology. Small banks don't generally have that luxury. Referring back to the article, whether small banks find a direct FinTech partner, work with an accelerator, or choose to pool their money with others like themselves in a trade association, one thing is clear: small banks cannot, and should not, tackle FinTech alone.

The Takeaway

It's not just millennials that have high expectations. All customers are becoming savvier. Not only that, but according to a recent survey by TD Ameritrade, millennials and baby boomers are more alike in their spending and savings habits than previously thought. All of this considered, community banks have great opportunities and big challenges in the face of changing behaviors and evolving technology. The players that come out on top will be the ones that rise up and respond, likely in the form of one or more of the FinTech partnership options discussed above. Community banks owe it to themselves and their customers to seek out the course of action that best answers the original predicament: the winning brand will execute on consumers' high expectations for both quality and service, and do so "yesterday."

The only option that is not viable? Doing nothing.