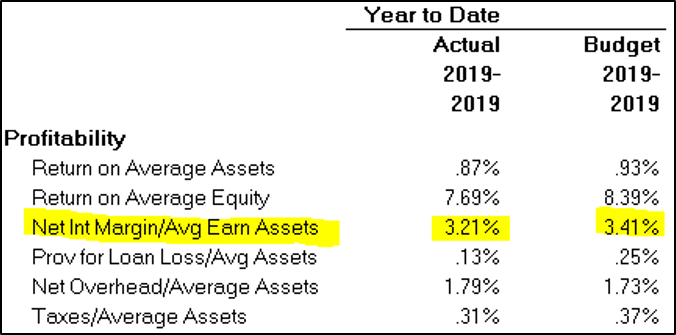

Given the historic low U.S Treasury rate environment and the recent 150 basis point near-immediate drop in rates, we’re expecting an increased regulatory focus on interest rate risk (IRR) and liquidity management.

It’s no doubt that financial institutions will see pressure to not only reforecast their 2020 budgets, but also to run future IRR shocks and more custom “what-if” scenarios as part of their regular IRR modeling program. Liquidity management and stressed-scenario cash flow modeling are also more important now than ever.

.jpg)