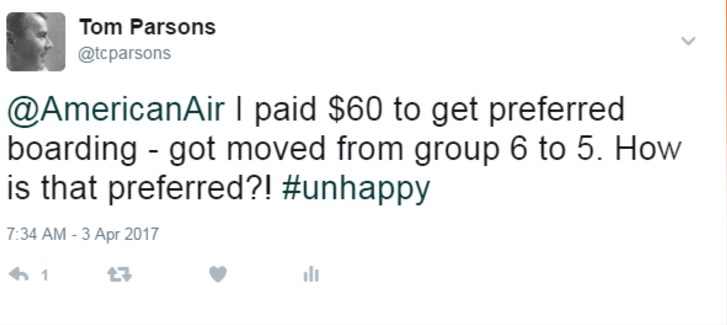

Last month I experienced the best service possible. It was from American Airlines (no, really) – and it was through social media of all things.

The Community Bank Strategic Planning Experiment: Using Your Model To Prepare for Rising Interest Rates

By 2020, millennials will account for 50% of the global workforce (PWC). And according to Gallup, only 29% of millennials are currently engaged at work.

That puts employers in a tough spot, considering this generation will eventually be charged with leading these organizations. And banks are not immune!

What is your bank doing now to prepare for the inevitable millennial takeover?

The FMS Forum: A Sneak Peek of My Talk on Millennial Employees

Plansmith will be at The FMS Forum in June. We'll be in the marketplace, and I'll be presenting a breakout session!

Social video is hot right now. So hot in fact that 90% of users say that product videos are helpful in the decision process (Hyperfine Media).

Don't let your bank fall victim to outdated preconceptions of strategy. Traditionally, strategy has been made out to be a big, scary word. It sounds daunting, dark, and almost threatening. Or, at the very least, kind of boring. But what you're thinking of is the strategic planning of the past.

Make strategic planning a priority that your team will take ownership of in a positive way. Here's how to put a fresh twist on your institution's strategy.

Virtually every business prepares a budget and calls it planning. Some actually develop strategic plans every couple of years to go through an exercise in search of new ideas and approaches. Very few, if any, reap or even appreciate the benefits of planning outside of the financial benefit they hope to realize. While the intentional outcome of these efforts is profit-based, the other powerful benefits are often overlooked. This includes building the necessary buy-in and trust within the organization to achieve the financial goals. For many organizations, this is the missing key that’s needed to support effective execution of the plan. It’s the lack of genuine buy-in that confines the plan to the top shelf of a bookcase somewhere.

When I made the leap to marketing after years of sales, I immediately rewound the last 25 years and watched a virtual VHS tape (yes, that old - click this if you don't remember) in search of what I learned. You see, I didn't have the luxury of learning on the job this time, I had to apply what I already knew and apply it fast.