Do you have appropriate policy limits for all key interest rate risk measurements? How did you set your set them, and do they really still make sense for your institution?

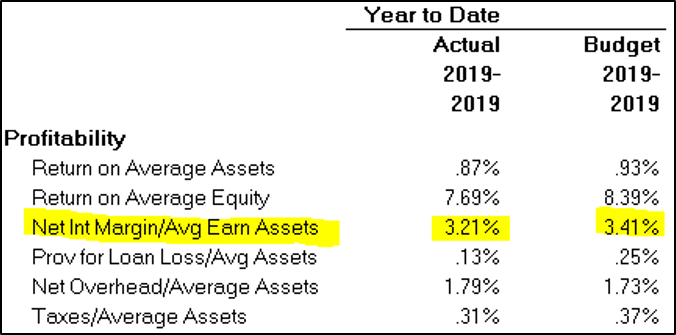

When market rates weren’t changing, most institutions were in general compliance with policy limits. However, with the steady ramp up of rates through mid-2019, and then the massive drop in March of 2020, we’ve seen numerous financial institutions fall out of policy compliance. We’ve also heard from many of our clients that just aren’t sure what they should use for limits for the various non-parallel rate shock scenarios and now emphasized net income shock measurements. The old industry standard limits that so many institutions are still using just don’t seem to be working anymore.